A Florida House subcommittee this week approved a bill that would mandate human involvement in property insurance claims denials, a sign of the times as insurers employ more artificial intelligence on multiple fronts.

House Bill 527 is sponsored by state Rep. Hillary Cassel, a policyholder attorney and the vice chair of the House Commerce Committee’s instrumental Insurance and Banking Subcommittee. It would require carriers to indentify the “human professional who made the decision to deny the claim or a portion of the claim.”

The bill, which passed the subcommittee Tuesday, also would make insurers include a statement that AI, algorithms or machine learning were not the sole basis for denying the clam.

“An insurer that uses an algorithm, an artificial intelligence system, or a machine learning system as part of its claims-handling process shall detail in its claims-handling manual the manner in which such systems are to be used and the manner in which the insurer complies with this section,” the bill reads.

Cassel said the bill was prompted in part by the 2024 shooting of UnitedHealthcare CEO Brian Thompson one year ago in New York. Reports have suggested that when AI was used to deny United’s claims, most of the denials had errors, Cassel said, according to Florida Politics news site and a recording of the subcommittee meeting.

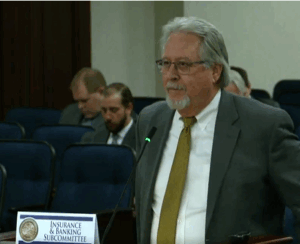

Insurance interests noted that AI now plays an important role in claims management. Robert Passmore, with the American Property and Casualty Insurance Association, said at the subcommittee meeting that limits on AI could slow the claims process, and that artificial intelligence can actually help reduce errors, the news site reported.

The bill has a way to go if it is to become law, including more House and Senate committees and floor votes. A Senate version of the bill is SB 202. The full Florida Legislature convenes Jan. 13 for its 60-day session.

The excess policy purchased by the sheriff’s office in 2017 had a policy limit of $2.5 million. The sheriff was self-insured up to $500,000, and the policy had a $500,000 deductible.

The sheriff had stationed a deputy as a school resource officer at Marjory Stoneman Douglas High School in Parkland. After a teenaged gunman opened fire in 2018, killing 17 students and teachers and injuring others, the sheriff faced as many as 60 lawsuits from families of the victims, who argued the resource officer had acted negligently and failed to stop the killings.

Evanston, a Markel Group subsidiary, essentially denied liability and legal defense coverage, contending that the “separate occurrence” clause meant that each injury or death constituted a separate incident–meaning the $500,000 deductible and $500,000 self-insurance retention had to be met for each injury claim before coverage would kick in. By that measure, the sheriff’s office would have needed to spend as much as $60 million on legal costs and judgments before Evanston provided coverage.

Broward Sheriff Gregory Tony and his attorneys argued that the shooting was a single occurrence and that the retention and deductible had been exceeded by the multiple lawsuits and legal fees. The sheriff asked the trial court to declare that Evanston must provide coverage. The trial court, the U.S. District Court in Southern Florida, agreed in 2024, finding that the Evanston policy did not clearly define a “separate occurrence,” and any ambiguity must be construed in favor of the insured.